Matt Coletta is the is the Co-Founder / Managing Partner of M&A Business Advisors, a full-service Business Brokerage and M&A Advisory Firm.

With more than 30 years representing buyers and sellers in the confidential sale of privately owned businesses, he’s experienced in working with a wide range of industries including Manufacturing, Distribution, Service, E- Commerce, Technology, Software, Health Care, Construction, Automotive, Food & Beverage Related Businesses and many others. Here are some of the questions we were curious about:

What was happening with buying and selling of businesses during COVID, and how is that changing now 2+ years down the road?

The beginning of 2020 was very active with businesses selling at strong multiples. The buyer pool was strong and they were open to taking on more risk given the strength of the economy and the lower cost of money. The labor pool up was also healthy. Fast forward into the second half of 2020, we started seeing buyers become more cautious. Supply chain issues started coming in play which made it difficult. Cost of money was still attractive during that time so transactions were still being completed.

In 2021, we saw a similar trend where quality businesses were getting sold. As we moved into 2022, we started seeing the cost of money beginning to rise significantly as inflation increased. The labor pool continued to change and the cost of labor starting go up rapidly.

The labor shortage in 2022 became the number-one negative effect for business owners. The cost to maintain labor and inflation overall were second and third. Fortunately, businesses sell in all types of environments, especially quality businesses that can show proof of concept and weather the storm. There is a lot of money in the marketplace looking for businesses that have the ability to forge ahead and show that their products or services will always be in demand.

What businesses are “hot” right now in terms of demand or increasing value?

As far as businesses in the lower middle market space ($2M-$30M in enterprise value), which is what we focus on, the breakdown is as follows by industry sector (from highest in demand to lowest):

- Manufacturing

- Construction & Engineering

- Food Related

- Wholesale & Distribution

- Business Services

- Consumer Goods

- Health Care & Biotech

- Personal Services

- Information Technology

While all transactions are different from one another, what kind of range of time should a business owner expect from the time they contact you to the time they actually close the transaction?

The time that is needed to properly sell and close a transaction is something that many business owners underestimate. I’ve had numerous sellers send me a note after the transaction has closed and tell me that not only did they underestimate how long it took to prepare the business for sale, they underestimated the time it took to finally close the transaction and transition out of it.

Most business owners are not fully prepared when it comes to selling their business. Every business is different so we need to have a lengthy conversation with the owner and “look under the hood” to see what is happening with their particular business. We also need to analyze their financials to make sure the business has sufficient, verifiable cash flow. Sometimes, we need to suggest that the business owner make certain changes or improvements so that the business is in a better position to sell.

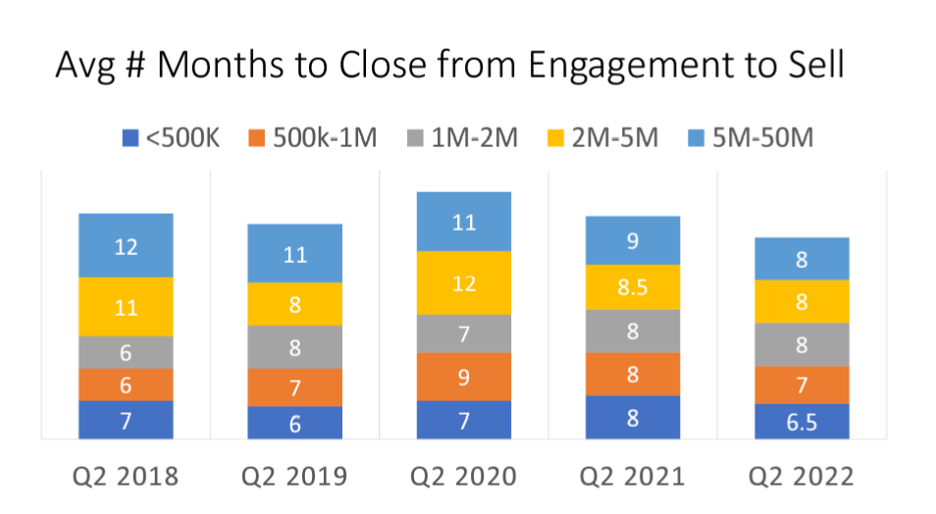

If the business is ready to go to market, we will typically take 2-3 weeks to complete a calculation of value report. We then move forward and sign an engagement agreement. Here are some stats on the average number of months to close from engagement to closing based on revenue size.

Matt Coletta, CBB, CBI, M&AMI

Co-Founder / Managing Partner

M&A Business Advisors

mabusinessadvisors.com

matt@mabusinessadvisors.com

(818) 999-9621